Don’t you think it’s become more common lately to be asked to pay accommodation or hot spring taxes when staying at inns or hotels?

What’s that? …Well, if it’s 200 yen, I guess that’s fine.

Wait a second!

You might think it’s just a few hundred yen, but sometimes it’s unexpectedly expensive and surprising!

In the hugely popular tourist destination of Kyoto, it can even be as much as 10,000 yen per person!

So, I’ve put together a summary of accommodation and hot spring taxes across Japan.

There’s also a handy list showing exactly how much is added to your lodging fee at a glance, so be sure to check it before you travel.

This article is recommended for people like this!

- People who want to learn about accommodation and hot spring taxes

- Those who want to know in which regions they’ll need to pay them when traveling

- Anyone considering a hot spring trip

- What are accommodation tax and hot spring tax?

- Prefectures and municipalities where accommodation tax is applied

- [Table] Summary of accommodation tax rates in applicable regions

- Prefectures and municipalities where hot spring tax (surtax) is applied

- [Table] Summary of hot spring taxes in famous resorts across Japan

- Finally

What are accommodation tax and hot spring tax?

These are taxes applied when staying at hotels or inns.

In some cases, the prefecture is the taxing authority, while in others individual municipalities impose the tax—and sometimes both may apply.

Not all regions have introduced such taxes.

As of December 2025, accommodation taxes have been implemented in the following prefectures and municipalities.

Kutchan Town / Niseko Town / Akaigawa Village, Hokkaido

Hirosaki City, Aomori Prefecture

Kanazawa City, Ishikawa Prefecture

Atami City, Shizuoka Prefecture

In other regions, accommodation tax is not required.

However, starting in 2026, accommodation taxes are scheduled to be introduced in Hokkaido (including popular tourist cities), Morioka City in Iwate Prefecture, Sendai City in Miyagi Prefecture, Yugawara Town in Kanagawa Prefecture, Nagano Prefecture, Hiroshima Prefecture, and Kumamoto City in Kumamoto Prefecture.

This is a tax applied when bathing or staying at facilities with hot springs.

The Ministry of Internal Affairs and Communications sets the standard at 150 yen per person per day, and many hot spring resorts collect this amount.

Depending on the hot spring, the tax varies, ranging from 20 yen to 500 yen.

Prefectures and municipalities where accommodation tax is applied

Here is the list of prefectures that have introduced accommodation tax. (Items shown with strikethrough are currently not scheduled for introduction)

Prefectures without notes on “planned” or “under consideration” have already introduced accommodation tax.

☟ Click to jump to the linked page.

- 【Hokkaido】

- 1. Accommodation tax in Hokkaido

- 【Tohoku Region】

- 2. Accommodation tax in Aomori Prefecture

3. Accommodation tax in Akita Prefecture- 4. Accommodation tax in Iwate Prefecture (planned)

- 5. Accommodation tax in Miyagi Prefecture (planned)

- 6. Accommodation tax in Yamagata Prefecture (under consideration)

7. Accommodation tax in Fukushima Prefecture- 【Kanto Region】

- 8. Accommodation tax in Tokyo

- 9. Accommodation tax in Kanagawa Prefecture (planned)

- 10. Accommodation tax in Tochigi Prefecture (planned)

- 11. Accommodation tax in Chiba Prefecture (under consideration)

- 12. Accommodation tax in Ibaraki Prefecture (under consideration)

13. Accommodation tax in Gunma Prefecture14. Accommodation tax in Saitama Prefecture- 【Hokuriku Region】

- 15. Accommodation tax in Ishikawa Prefecture

- 16. Accommodation tax in Toyama Prefecture (under consideration)

17. Accommodation tax in Niigata Prefecture18. Accommodation tax in Fukui Prefecture- 【Koshinetsu Region】

- 19. Accommodation tax in Nagano Prefecture (planned)

20. Accommodation tax in Yamanashi Prefecture- 【Tokai Region】

- 21. Accommodation tax in Shizuoka Prefecture

- 22.Accommodation tax in Aichi Prefecture

23. Accommodation tax in Gifu Prefecture24. Accommodation tax in Mie Prefecture- 【Kansai Region】

- 25. Accommodation tax in Osaka Prefecture

- 26. Accommodation tax in Kyoto Prefecture

27. Accommodation tax in Shiga Prefecture28. Accommodation tax in Nara Prefecture29. Accommodation tax in Wakayama Prefecture30. Accommodation tax in Hyogo Prefecture- 【Chugoku Region】

- 31. Accommodation tax in Hiroshima Prefecture (planned)

- 32. Accommodation tax in Okayama Prefecture (under consideration)

33. Accommodation tax in Tottori Prefecture34. Accommodation tax in Shimane Prefecture35. Accommodation tax in Yamaguchi Prefecture- 【Shikoku Region】

- 36. Accommodation tax in Kagawa Prefecture (under consideration)

37. Accommodation tax in Tokushima Prefecture38. Accommodation tax in Ehime Prefecture39. Accommodation tax in Kochi Prefecture- 【Kyushu Region】

- 40. Accommodation tax in Fukuoka Prefecture

- 41. Accommodation tax in Nagasaki Prefecture

42. Accommodation tax in Saga Prefecture- 43. Accommodation tax in Kumamoto Prefecture (planned)

44. Accommodation tax in Oita Prefecture- 45. Accommodation tax in Miyazaki Prefecture (planned)

46. Accommodation tax in Kagoshima Prefecture- 47. Accommodation tax in Okinawa Prefecture (under consideration)

- 【Table】 Summary of accommodation tax rates in applicable regions

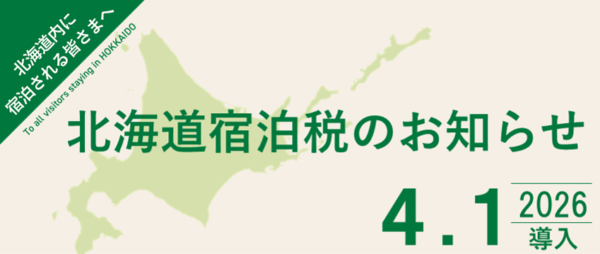

Starting from April 2026, accommodation tax will be applied in every municipality across Hokkaido.

Therefore, in certain areas of Hokkaido listed below, guests will be required to pay both the accommodation tax imposed by Hokkaido Prefecture and the additional tax levied by the municipality.

In addition, municipalities that had already been considering the introduction of accommodation tax will also begin collecting it starting April 1, 2026.

☝ Back to the list of accommodation taxes for all 47 prefectures

Where is “Kutchan Town”?

Many people may feel that way.

Kutchan Town is located next to Niseko Town and is home to Mount Yōtei.

Together with Niseko Town, it forms the Niseko Resort area, which attracts many tourists from both Japan and abroad.

Due to foreign companies purchasing land and engaging in real estate development, the Yamada district of Kutchan Town recorded the highest residential land price growth rate in Japan for three consecutive years starting in 2006.

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

*Students on school trips and accompanying teachers are exempt from the accommodation tax.

Bathing tax: ¥150 for overnight stays / ¥70 for day trips.

☝ Back to the list of accommodation taxes for all 47 prefectures

Niseko Town, famous for its superb snow quality, is extremely popular with overseas tourists.

Although the introduction of an accommodation tax had long been under consideration in Niseko Town, it was finally fully implemented at the end of 2024.

Furthermore, from November 1, 2026, the town aims to revise the system to a flat 3% rate.

It is understandable, as maintaining and promoting tourist destinations requires significant funding.

The intended uses of Niseko Town’s accommodation tax are being considered as follows:

- Enhancement of local transportation

- Promotion and support for reducing the environmental impact of accommodation businesses

- Strengthening of the tourism association, development of tourism personnel, and promotion of tourism digitalization

- Measures for landscape and environmental conservation

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

☝ Back to the list of accommodation taxes for all 47 prefectures

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

☝ Back to the list of accommodation taxes for all 47 prefectures

When thinking of a trip to Hokkaido, Sapporo is likely the first place that comes to mind.

I personally love it and have visited many times.

Unfortunately—or perhaps inevitably—due to the increase in tourists, an accommodation tax is set to be introduced.

It is scheduled to begin in April 2026.

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

Like Sapporo, Hakodate is a popular tourist destination.

Its night views and Goryōkaku are breathtakingly beautiful.

This is the combined amount of Hakodate City’s accommodation tax and Hokkaido’s accommodation tax.

☝ Back to the list of accommodation taxes for all 47 prefectures

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

☝ Back to the list of accommodation taxes for all 47 prefectures

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

☝ Back to the list of accommodation taxes for all 47 prefectures

In addition to the above amount, Hokkaido’s accommodation tax will also be charged(2026/4/1~)

☝ Back to the list of accommodation taxes for all 47 prefectures

Aomori Prefecture has introduced the Tohoku region’s first accommodation tax.

☝ Back to the list of accommodation taxes for all 47 prefectures

Morioka City, well known for its signature Morioka Reimen noodles.

Starting in October 2026, the introduction of an accommodation tax has been officially decided.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Miyagi Prefecture, the introduction of an accommodation tax has been decided both at the prefectural level and in Sendai City.

Previously, there had been discussions about introducing such a tax.

But due to the heavy burden on accommodation businesses caused by the COVID-19 pandemic, the plan was temporarily withdrawn.

After renewed deliberations, it has now been decided that the accommodation tax will officially be implemented starting January 2026.

If you book a hotel in Sendai City, an additional accommodation tax for Sendai City will be charged.

The bathing tax in Sendai City is ¥150 for overnight stays and ¥70 for day trips.

☝ Back to the list of accommodation taxes for all 47 prefectures

It is still at the draft stage, but Yamagata City is also considering the introduction of an accommodation tax.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Tokyo, which attracts tourists from all over the world, an accommodation tax is applied across the entire metropolitan area.

However, if the room-only rate (excluding meals and other charges) does not exceed ¥10,000 per night, the tax is not levied.

In other words, “if you stay at a high-end ryokan or hotel, you’ll have to pay.”

Due to the rapid increase in tourists both domestic and international, Tokyo’s accommodation tax system is currently under review.

A draft proposal has been submitted to raise the tax to a flat 3% by sometime in 2027.

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

☝ Back to the list of accommodation taxes for all 47 prefectures

参考:001033235.pdf(Ministry of Internal Affairs and Communications, MIC)

☝ Back to the list of accommodation taxes for all 47 prefectures

Chiba Prefecture, well known for having “Tokyo Disneyland” despite being in Chiba.

In addition to the prefectural accommodation tax, extra accommodation taxes are being considered in popular tourist cities such as Urayasu, Minamiboso, Chiba, and Narita.

以下の市に宿泊する場合、県・市の両方の宿泊税が課されます。

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

*However, the tax amount will be capped at ¥2,000.

☝ Back to the list of accommodation taxes for all 47 prefectures

Kanazawa, a tourist city where visitors can enjoy not only its culinary appeal but also cultural attractions such as the 21st Century Museum of Contemporary Art and Kenrokuen Garden, has introduced an accommodation tax.

Here, even if the accommodation fee is low, a minimum tax of ¥200 is always levied.

The threshold for the accommodation tax has been lowered from ¥20,000 to ¥5,000. (2024.10.1~ )

The bathing tax is ¥150 for overnight stays and ¥100 for day trips.

Therefore, if you stay at a ryokan with hot springs in Kanazawa City, you will need to pay at least ¥350 per person in additional charges.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Tateyama Town, home to the majestic “Tateyama” where visitors can enjoy breathtaking views after a moderately challenging climb, discussions have begun on introducing an accommodation tax.

At present, the tax rate has not yet been determined.

*However, for the first three years, a flat rate of ¥200 will apply.

☝ Back to the list of accommodation taxes for all 47 prefectures

Atami, a hot spring resort easily accessible from the Tokyo metropolitan area, has introduced an accommodation tax starting in 2025.

The revenue will be used for initiatives such as hosting fireworks festivals and improving free Wi-Fi services for visitors.

*Children in elementary school and below, as well as school trips, are exempt.

☝ Back to the list of accommodation taxes for all 47 prefectures

Tokoname, a city famous for its pottery, has also introduced an accommodation tax starting in 2025.

The revenue collected from this tax will be used to improve facilities for travelers and to promote the city both domestically and internationally.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Osaka, the city of food and laughter, an accommodation tax is levied when the room rate exceeds ¥7,000.

The fact that the tax increases gradually depending on the accommodation fee gives the impression that it takes tourists’ budgets into consideration.

The accommodation tax in Osaka Prefecture was revised starting September 1, 2025. For reference, until August the rates were 0, 100, 200, and 300 yen, respectively, as shown in the table above

☝ Back to the list of accommodation taxes for all 47 prefectures

Kyoto, the ancient capital that captivates not only Japan but people from all over the world, introduced an accommodation tax at the city level, rather than across the entire prefecture.

Given that Kyoto City has far more tourist attractions and hotels compared to other municipalities, most visitors to Kyoto Prefecture are likely to stay within Kyoto City.

In Kyoto City, the accommodation tax is levied regardless of the room rate.

A revision of the accommodation tax is now under consideration.

If the accommodation fee reaches ¥100,000 or more (excluding meal charges and consumption tax), the accommodation tax alone amounts to ¥10,000!

Whaaat?! A tax of ¥10,000?!

If you don’t know about this beforehand, you might be shocked at the hotel counter.

It really feels too expensive… Combined with consumption tax, the total tax burden could reach ¥20,000.

※ Students on school trips are exempt from the accommodation tax.

aBathing tax: ¥150 for overnight stays / ¥100 for day trips.

☝ Back to the list of accommodation taxes for all 47 prefectures

In the Shikoku region, an accommodation tax has not yet been introduced.

Discussions are underway in Kotohira Town, Tonosho Town, and Shodoshima Town regarding the implementation of such a tax.

At present, the tax amount has not been decided.

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

Hiroshima, a destination rich in sightseeing spots, history, and gourmet food, has officially decided to introduce an accommodation tax.

Personally, it’s a prefecture I love and have visited many times.

The fresh oysters you can eat in Hiroshima are simply the best — so even with the new accommodation tax, I’ll definitely keep going!

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

Okayama Prefecture has been gaining popularity in recent years, especially for the scenic beauty of the Kurashiki Bikan Historical Quarter.

Discussions are underway regarding the introduction of an accommodation tax in Kurashiki City, home to the Bikan District, and in Okayama City, the prefecture’s central hub.

At present, the tax rate has not yet been decided.

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Fukuoka Prefecture, accommodation tax is collected at both the prefectural and city levels (currently only in Fukuoka City and Kitakyushu City).

Some have questioned whether this amounts to “double taxation,” but as shown in the table, regardless of which city you stay in, the total is either ¥200 or ¥500.

The difference lies in whether the tax is collected by the prefecture or the city.

However, the official website clearly states: “If a municipality introduces a new accommodation tax, the prefectural tax rate will be ¥100 per person per night.”

Therefore, if other municipalities in the future impose an accommodation tax exceeding ¥100, the total amount could rise above ¥200.

The bathing tax is ¥50 for both overnight stays and day trips.

☝ Back to the list of accommodation taxes for all 47 prefectures

楽天トラベルInstead of at the prefectural level, the introduction of an accommodation tax is planned at the city level.

Kumamoto City is famous for Kumamoto Castle.

☝ Back to the list of accommodation taxes for all 47 prefectures

nstead of at the prefectural level, the introduction of an accommodation tax is planned at the city level.

Miyazaki City is scheduled to begin on exactly the same date and with the same tax rate as Kumamoto City.

Miyazaki City is famous for Aoshima Shrine.

☝ Back to the list of accommodation taxes for all 47 prefectures

In Nagasaki Prefecture, the accommodation tax has been introduced only in Nagasaki City.

☝ Back to the list of accommodation taxes for all 47 prefectures

Currently, Okinawa Prefecture does not have an accommodation tax. However, the introduction of such a tax is being considered for the latter half of 2026.

*Maximum cap: ¥2,000 per person per night

The bathing tax is ¥150.

☝ Back to the list of accommodation taxes for all 47 prefectures

[List] Summary of Accommodation Tax Rates by Region

Here is a summary of the accommodation taxes currently introduced in various regions.

The rates and amounts shown are as of December 2025.

For regions where introduction, consideration, or revision is planned, please refer to the detailed notes above.

Be sure to check before your trip~

\\\ If you’re looking to book accommodations or leisure activities, then Rakuten Travel is the go‑to choice. ///

☞ Tap here to go to the official website

\\\ Rakuten Points pile up quickly! ///

Official website : Rakuten Travel: Book quality hotels and ryokans in Japan and beyond

Prefectures and municipalities where bathing tax (surtax) is levied

As of 2018 (Heisei 30), the bathing tax had been introduced in 992 municipalities nationwide (counting the Tokyo metropolitan wards as one municipality).

Of these, 91.3% apply the standard tax rate of ¥150, with rates ranging from a minimum of ¥20 to a maximum of ¥500.

This means that in most hot spring areas, visitors are required to pay a bathing tax, typically ¥150 per adult.

However, this refers to the standard rate (adult, overnight stay). Depending on the municipality, exemptions or reductions may apply for day-use visitors, children under 12, school trip students, those bathing for medical purposes, youth hostel users, or facilities charging ¥1,000 or less.

According to the Ministry of Internal Affairs and Communications, the bathing tax rate is set at a standard of ¥150 per person per day.

Charging a bathing tax higher than the standard ¥150 is referred to as a “surtax.”

From my research, the municipalities that have introduced a surtax are the following five hot spring resorts.

If there are others, I will add them as they are identified, so please let me know.

For other hot spring areas, you can rest assured that the maximum is generally ¥150 per adult per night.

- Hokkaido – Kushiro City / Lake Akan Onsen, Kushiro Onsen

Bathing tax: ¥300 per adult (overnight stay)

Day-use bathing: ¥90

From April 2025, the tax was raised from ¥250 → ¥300.

- Hokkaido – Noboribetsu City / Noboribetsu Onsen

Bathing tax: ¥300 per adult (overnight stay)

On April 1, 2020, the tax was raised from ¥150 → ¥300.

- Mie Prefecture – Kuwana City / Nagashima Onsen (partially)

Bathing tax: ¥210 per adult (overnight stay)

This hot spring area is located in Kuwana City, famous for Nagashima Spa Land and Nabana no Sato.

The municipal official website did not show bathing tax information, but some accommodation websites list it as ¥210.

It seems that the fee may vary depending on the facility.

- Osaka Prefecture – Minoh City / Minoh Onsen

Bathing tax: ¥200 per adult (overnight stay)

- Okayama Prefecture – Mimasaka City / Yunogo Onsen

Bathing tax: ¥200 per adult (overnight stay)

- Oita Prefecture – Beppu City / Beppu Onsen

Bathing tax: ¥50 – ¥500 per adult (overnight stay)

In Beppu Onsen, the bathing tax is levied in proportion to the accommodation fee + meal fee.

Unlike Tokyo’s accommodation tax, which is calculated on the lodging fee excluding meals, Beppu’s bathing tax includes meals—so please take note!

If you book a higher‑end ryokan without realizing this, you might end up paying ¥500 bathing tax for two people.

Be careful!

For long-term stays (7 nights / 8 days or more), the bathing tax is reduced by half.

*The table above shows the bathing tax for short-term stays (day-use to 6 nights / 7 days). For long-term stays (7 nights / 8 days or more), the half-rate applies starting from the first night.

[List] Summary of Bathing Taxes in Famous Hot Spring Areas Nationwide

We’ve compiled the bathing tax information for popular hot spring resorts that rank among the top nationwide!

By clicking on the name of each hot spring (e.g., “〇〇 Onsen”), you can access the official municipal website where the bathing tax details are listed.

For those who want to know more, please make use of these links!

Finally

Thank you very much for reading all the way to the end!

By reading this article, I hope it has helped answer your questions such as:

What are accommodation tax and bathing tax? How much do they cost?

When planning your next trip, it’s a good idea to consider not only the accommodation fee but also the taxes that may apply when setting your budget ◎

Well then, see you again 👐

\\\ If you’re looking to book accommodations or leisure activities, then Rakuten Travel is the go‑to choice. ///

☞ Tap here to go to the official website

\\\ Rakuten Points pile up quickly! ///

Official website : Rakuten Travel: Book quality hotels and ryokans in Japan and beyond

☟Go back to HOME

☟ Summary of hot spring articles

☟ Summary of domestic and overseas travel articles (excluding Thailand)

USJ Thrill Ride Scare Ranking – Which Rides Aren’t Scary? For Fearful Riders, No.1 Is Traumatic!

[Summary] How much are accommodation and hot spring taxes across Japan’s 47 prefectures?

[Biggest Guide] 30 Must-Try Street Foods in Kusatsu Onsen! Without a Reservation You Might Miss Dinner?!

~Travel in Japan~ Over-night bus ranking: Discover the best cost-effective options!

18 Must‑Try Street Foods in Kinosaki Onsen: From Crab to Sweets to Savory Bites—A Hot Spring Town Made for Strolling